I saw today where drilling permits were down almost 40% for this past November due to declining oil prices.

Announcement

Collapse

No announcement yet.

Hey Oilfield Guys!!

Collapse

X

-

I think the OP was referring to just this type thing. It doesn't matter if you are a country or a new oil field worker, if you are spending as fast or faster than you are making it, you in trouble! In both cases they are spending money they haven't earned yet.Originally posted by Tbar View PostThis was posted on another site.......

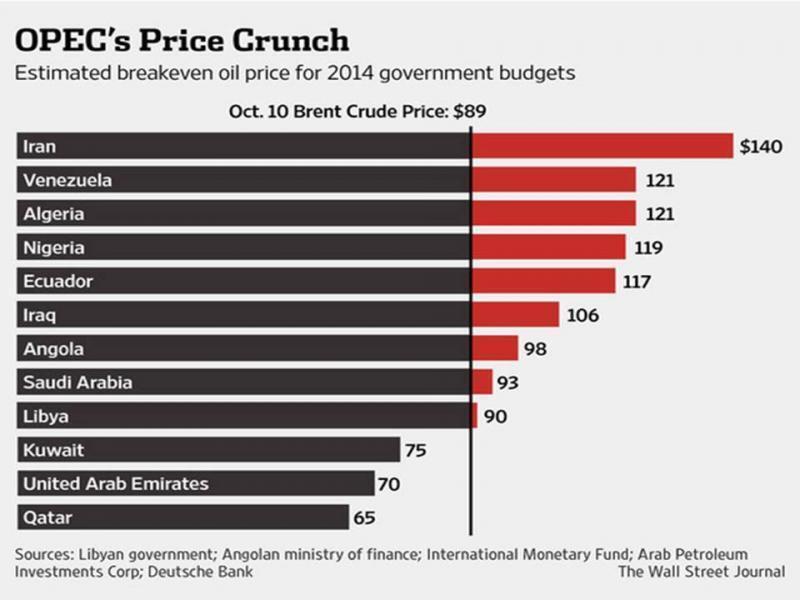

Producer Country Break Even Prices

Venezuela ~ $125.00pbl

Russia ~ $105.00pbl

Saudi is at $93, but what it doesn't show is the $800 billion they have in reserve. Surplus money.Last edited by BrianL; 12-03-2014, 12:55 PM.

Comment

-

Spending spree

Your are 100% correct Bobby. I know several folks making BIG JACK right now in different aspects of this industry from trucking to land men to rig welders(pipe liners) and most are spending it as fast as they make it. I know kids barely old enough to shave making 3 figures and then some and they are burning through it like there is no tomorrow.

Of course I probably would have done the same if I ever had the chance when I was that young. but hey..

but hey..

I try to share my wisdom and I tell them to put back for the slow down, the hard times and the rainy days but it's in one ear and out the other.

Comment

-

Same argument was made in 01-02 when all the young tech folks were rolling in money, most of it options. They were spending almost every dollar they made because they saw their options and deferred comp shares increasing in value every day. 01-02 was a great time to buy a 1-2yo BMW with few miles on it.Originally posted by Aggie_bowtech View PostI don't like the jokes about how stupid people are by living outside of their means in just the O/G market. That's the new American way, right??? Even worse, people are talking about how they don't feel bad for them and can't wait to buy their repo'd trucks. Don't make fun of the guys working 120 hours a week that are enjoying having some credit, make fun of the people that don't work that take all of our money in welfare, etc. If I worked 120 hours a week I would probably buy a bunch of bad arse crap too!

Same thing said when the RE went gangbusters in some areas of the country in 07-09. People without much sense were cash out refinancing to increase their standard of living thinking their house would never go down in value. 10-11 was a great time to buy a nice house from the bank at a deep discount.

This isnt a conviction of the O&G market solely...its just their time in a market cycle.Last edited by JeffJ; 12-03-2014, 01:10 PM.

Comment

-

Originally posted by Take Dead Aim View PostWhere did I saw that oil has absolutely nothing to do with a downtur . Reading comprehension is not the strong suit of a few on here. I said it is not the cause of the downturn. Like the last recession was caused by defaulting loans and a bunch of other poor practices. Oil had nothing to do with that downturn. It actually help Texas market take a smaller loss and brought us back faster.

Check your PMs....

Comment

-

the only person talking about a total nation wide collapse is you....Originally posted by Take Dead Aim View PostCrash in the 80's was Savings and Loans. Thank Carter for deregulating the S&L. Yes the oil market went with it but it was not a cause of the economy falling. When the economy goes South oil follows. That is the missing link everyone has trouble seeing. There has never been a US economic crash caused by oil prices dropping. Does it hurt specific areas sure. Will towns go by the waste-side again like they do every other time the price of oil has dropped to lows. Sure. They existence is based solely on a commodity and a highly volatile one at that.

If you look at the charts below you will see that when oil(in RED) rises to highs a recession/adjustment(GRAY) was soon to follow. Not the other way around. I will say it again. I don't want the bottom to fall out of oil. Nothing good comes from that. I have been stating that a drop in prices is not as bad as many have made it out to be. If the bottom does fall out there will be many that over extended themselves and will fall on hard times. That sucks. The current drop is personally costing me a decent amount on one side and saving me a little on the other. Fortunately I don't have to count on either of those to survive so is it bearable at the moment. All I was trying to do is give a more realist view of the landscape and not a sky is falling and Texas will become Detroit.

I think we're all fully aware the potentail crash of the oilfield will not bring about the zombie apacolypse, but to deny it will have a wide spread effect is ignorant.

Comment

-

Originally posted by Take Dead Aim View PostCrash in the 80's was Savings and Loans. Thank Carter for deregulating the S&L. Yes the oil market went with it but it was not a cause of the economy falling. When the economy goes South oil follows. That is the missing link everyone has trouble seeing. There has never been a US economic crash caused by oil prices dropping. Does it hurt specific areas sure. Will towns go by the waste-side again like they do every other time the price of oil has dropped to lows. Sure. They existence is based solely on a commodity and a highly volatile one at that.

If you look at the charts below you will see that when oil(in RED) rises to highs a recession/adjustment(GRAY) was soon to follow. Not the other way around. I will say it again. I don't want the bottom to fall out of oil. Nothing good comes from that. I have been stating that a drop in prices is not as bad as many have made it out to be. If the bottom does fall out there will be many that over extended themselves and will fall on hard times. That sucks. The current drop is personally costing me a decent amount on one side and saving me a little on the other. Fortunately I don't have to count on either of those to survive so is it bearable at the moment. All I was trying to do is give a more realist view of the landscape and not a sky is falling and Texas will become Detroit.

When referring to ones reading comprehension please reread your first two sentences in the above post. Again please refer to the Texas economy since that is what all my post have been about.

Comment

-

That would be perfectly okay to only talk the Texas economy but the downfall in the early 80's was just like the one in 2008 and was nation wide. I didn't bring u the 80's. You can't just talk the Texas economy when it was a nation wide issue caused by bankers that couldn't regulate themselves.Originally posted by Hardware View PostWhen referring to ones reading comprehension please reread your first two sentences in the above post. Again please refer to the Texas economy since that is what all my post have been about.

Comment

-

But it doesn't account for the 10s of thousands of other goods/stores that support the oil field. You have any idea how many side x sides and trucks are sold to people in the oil patch? How many new hotels, food places, etc. will go bye-bye if the boom goes bust? Almost every oil company has offices in every big city. Guess what, they stop spending money in the cities during the bust too. How many realtors and CPAs are there making good money selling land to oil clients etc.. It goes on and on and on.Originally posted by Take Dead Aim View PostThat number is deceiving. It accounts for every person that works in a gas station, propane store, etc. The 20% number is wrong to begin with and then you deduct gas station attendees and the like it drops even more. Yes is a big industry in Texas but Texas can survive if the oil industry in down. We are not Michigan or West Virginia and rely solely on one industry.

Comment

-

All those hotels, big new grocery stores, RV parks and everything that popped up in small town Texas will eventually go bye bye anyway. People saw an opportunity to make money and jumped at it. I don't blame them, I would do the same thing if that type of activity was going on in my town. But it's not permanent. Just make the money while you can, and put some away.Originally posted by RiverRat1 View PostBut it doesn't account for the 10s of thousands of other goods/stores that support the oil field. You have any idea how many side x sides and trucks are sold to people in the oil patch? How many new hotels, food places, etc. will go bye-bye if the boom goes bust? Almost every oil company has offices in every big city. Guess what, they stop spending money in the cities during the bust too. How many realtors and CPAs are there making good money selling land to oil clients etc.. It goes on and on and on.

Comment

-

Originally posted by Take Dead Aim View Post

(snip)

Lets look at the other side of the low oil prices.

Energy cost go down. Texas is the #1 user of energy in the Nation.

Transportation cost go down. Everything from food to fuel are cheaper.

Construction cost go down. Cheaper to build homes, road, etc.

Food cost go down. Cheaper food all around.

Farming and Ranch cost go down. Cheaper feed prices, deer corn, etc.

All of the above save everyone in the state money daily, weekly, and yearly. You are wanting to say that because of a small % hurt by the low oil prices things will go to H3LL in a hand basket. But what you are not accounting for is everyone in the state and country for that matter will gain something at the expense of that small %. I know that sounds bad but it is the truth and the great thing about capitalism.

I'm not sure where you learned that fuel prices going down drops the prices of everything else listed. i presume the first statement is correct, but "sticky" prices affect the rest of your statement. nothing drops in price when fuel costs decrease.

Comment

-

I agree what your saying about the 80's S&L and the 2008 mortgage crisis but completely disagree when it comes to oil during these times. Please see quote below pertaining to the oil crisis of the 80'sOriginally posted by Take Dead Aim View PostThat would be perfectly okay to only talk the Texas economy but the downfall in the early 80's was just like the one in 2008 and was nation wide. I didn't bring u the 80's. You can't just talk the Texas economy when it was a nation wide issue caused by bankers that couldn't regulate themselves.

"OPEC's membership began to have divided opinions over what actions to take. In September 1985, Saudi Arabia became fed up with de facto propping up prices by lowering its own production in the face of high output from elsewhere in OPEC.[16] In 1985, daily output was around 3.5 million bpd down from around 10 million in 1981.[17] During this period, OPEC members were supposed to meet production quotas in order to maintain price stability, however, many countries inflated their reserves to achieve higher quotas, cheated, or outright refused to accord with the quotas.[18] In 1985, the Saudis were fed up with this behavior and decided to punish the undisciplined OPEC countries.[19] They abandoned their role as swing producer and began producing at full capacity, which created a "huge surplus that angered many of their colleagues in OPEC".[20] High-cost oil production facilities became less or even not profitable. Oil prices as a result fell to as low as $7 per barrel"

This is what brought Texas to it's knees in the 80's and is what I have been referring about in all previous post!! It had nothing to do with the S&L crisis which is totally another subject and discussion.

A small decrease in oil prices can be beneficial but when the bottom falls out it isn't good for anyone.

Comment

-

Yes agree with all of that but why was oil so volatile? It was that US and World economy was in the tank. Yes there was a huge surplus of oil but it was caused by lack of demand. From the same wiki page you posted at the top. The world economy caused the oil to fall to record lows.Originally posted by Hardware View PostI agree what your saying about the 80's S&L and the 2008 mortgage crisis but completely disagree when it comes to oil during these times. Please see quote below pertaining to the oil crisis of the 80's

"OPEC's membership began to have divided opinions over what actions to take. In September 1985, Saudi Arabia became fed up with de facto propping up prices by lowering its own production in the face of high output from elsewhere in OPEC.[16] In 1985, daily output was around 3.5 million bpd down from around 10 million in 1981.[17] During this period, OPEC members were supposed to meet production quotas in order to maintain price stability, however, many countries inflated their reserves to achieve higher quotas, cheated, or outright refused to accord with the quotas.[18] In 1985, the Saudis were fed up with this behavior and decided to punish the undisciplined OPEC countries.[19] They abandoned their role as swing producer and began producing at full capacity, which created a "huge surplus that angered many of their colleagues in OPEC".[20] High-cost oil production facilities became less or even not profitable. Oil prices as a result fell to as low as $7 per barrel"

This is what brought Texas to it's knees in the 80's and is what I have been referring about in all previous post!! It had nothing to do with the S&L crisis which is totally another subject and discussion.

A small decrease in oil prices can be beneficial but when the bottom falls out it isn't good for anyone.

The 1980s oil glut was a serious surplus of crude oil caused by falling demand following the 1970s Energy Crisis. The world price of oil, which had peaked in 1980 at over US$35 per barrel ($100 per barrel today), fell in 1986 from $27 to below $10 ($58 to $22 today).[2][3] The glut began in the early 1980s as a result of slowed economic activity in industrial countries (due to the crises of the 1970s, especially in 1973 and 1979) and the energy conservation spurred by high fuel prices.[4] The inflation adjusted real 2004 dollar value of oil fell from an average of $78.2 in 1981 to an average of $26.8 per barrel in 1986.[5]

Comment

Comment